Bitcoin is finished

18 January 2018I personally don't deal in Bitcoin (or any other cryptocurrency), in part because I don't really have the time to give any trading markets proper attention, but it is something that has come up in conservation much more often than usual. A few weeks ago an overseas friend asked me to look into getting a Bitcoin account on a London exchange, but in the end I did not go through with it due to the exchange having just introduced a minimum £2,500 for deposits. At the time I did not think much of it and moved on. However it now looks like Bitcoin is collapsing in on itself.

Earlier this week I chanced across an article that was about Steam, the computer game buy & download outfit, no longer accepting bitcoins. The reason was a combination of the volatility in the market value of Bitcoin, and — more importantly in my opinion — sky-rocketing Bitcoin transaction costs. I will address these in order. Below is a snapshot of the Bitcoin-Euro exchange rate:

(Source: XE Charts)

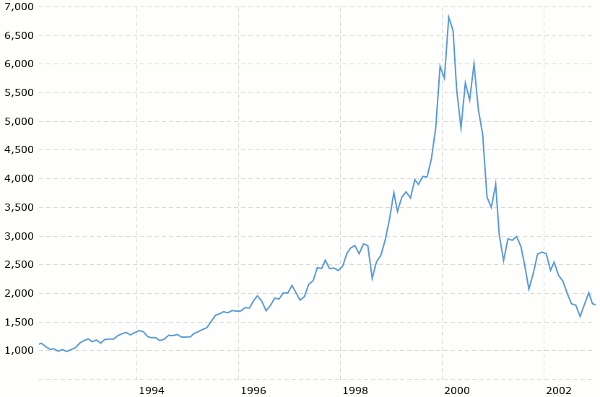

The Bitcoin-Dollar and Bitcoin-Sterling charts are pretty much the same pattern, which is also a familiar one: A comparatively long time with only a slight gradient, then a curve upwards, and then the steep mountain range. There is even two distinct peaks, which makes interesting comparison with the the NASDAQ (show below) around the time of the dot-com crash. Similar comparisons can also be made with the price of gold.

(Source: Macrotrends)

Two weeks ago when someone asked about Bitcoin I pointed out the similarity of these graphs as a reason to avoid it, and now Bitcoin is a bubble that has clearly burst. In fact it fell 30% in the two days since I took the two graph snapshots above, and I fully expect it to fall back below €5,000 in the very near future as the bull-run of last November reverses itself. If I meet that IT worker who a few weeks ago was trying to persuade me that moving Sterling into Bitcoin was a better bet than into Euros, the above should floor him.

However the second part of the reason Stream stopped accepting Bitcoin — transaction costs — may well kill off Bitcoin completely. Bitcoin is hitting a scalability problem with the computational work-load (a.k.a. Bitcoin mining) needed to properly sign off a transaction, and as a result transaction costs are sky-rocketing. That has the effect of both making Bitcoin less liquid as well reducing its velocity (roughly how quickly a Bitcoin can be re-used), and when anything gets in the way of how quickly and/or easily a form of money can be exchanged, its value usually goes down for the count.